Volatility

Investing becomes very emotional during volatile times in the market, like we are currently experiencing. Not three months ago we were reviewing statements that were at all time highs. The financial crisis is ten years in the rearview mirror and consumer confidence in the market had returned. Seemingly overnight all that changed. October brought the broad market down 10% from its high with many of the FAANG stocks declining closer to 20%.

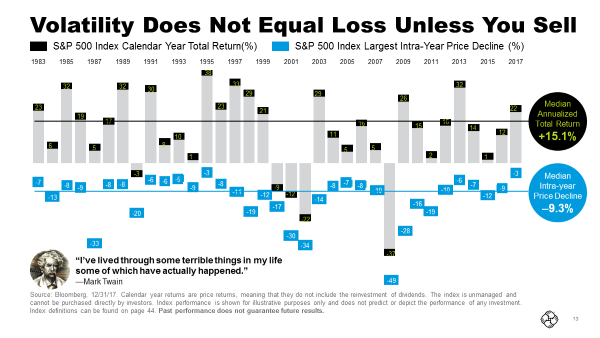

It is important to stay disciplined and stick to your investment plan during these trying times. A market loss is only solidified if you sell your securities while they are undervalued. Market volatility is normal. As you can see in the graph below that average intra-year price decline from 1980-2017 is a negative 9.3%. However, if you were able to stay disciplined and invested throughout the volatility your average annualized return would be 15.1%.

It is important that a financial plan accounts for unexpected withdrawals and expenses. This category of “safe money” in your portfolio should be ample enough or diversified enough to carry an investor through market turmoil, allowing the investor to sell securities when their value is higher.