The Proper Use of Bonds and Cash Equivalents in Today’s Economy

It’s common for many investors to want to get more conservative as they approach retirement. For decades financial professionals would advise clients to be invested primarily, if not in entirely, in bonds and cash equivalents (fixed income) when they retire. Another common rule was using your age for the allocation percentage to fixed income assets (A 30 year old would have a 30% bond allocation). These rules are not advisable given the current economic environment.

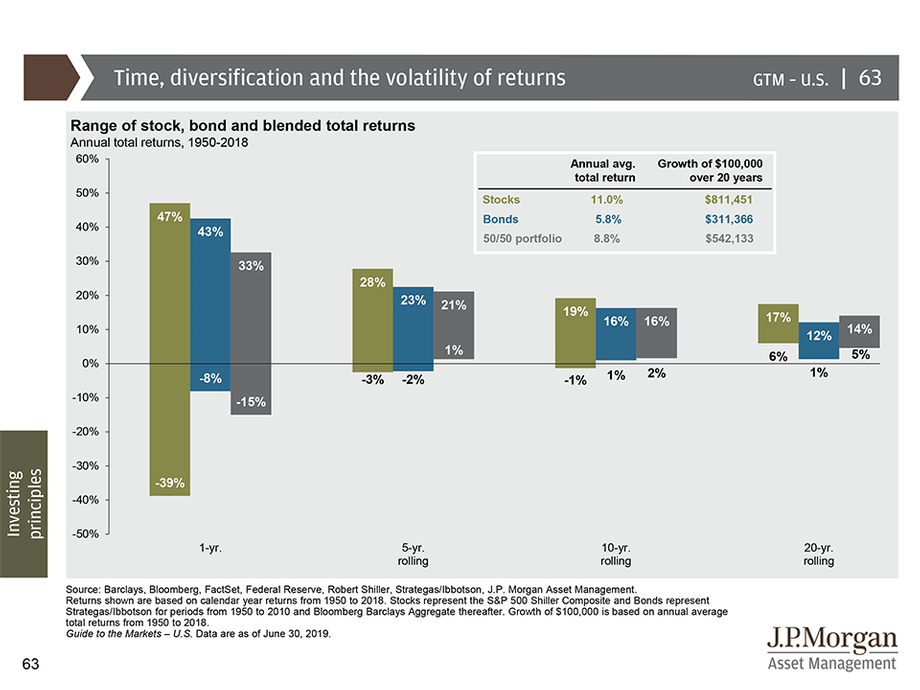

In the 1980s a 10-year treasury bill would yield upwards of 10%, today a 10-year treasury bill yields about 2.96%. Certificate of Deposit rates in 2007 were as high as 5%, today a long-term Certificate of Deposits may yield 2.8%. In comparison a stock portfolio (S&P 500) has a range of returns over a 10-year rolling period, from 1950-2018 of -1% to 19%, with an annual average return of 11%. See the chart below for additional information on rolling returns of stocks and bonds.

What is the proper role of fixed income in portfolios today? It depends on the situation but here is a modern approach. Fixed income should be used to “buy” time. Historically, bonds moved inversely to stocks. If stock prices were rising bond prices were falling. In recent years bonds have moved up and down with stocks. However, bonds do not move as drastic as stocks. For example, in the chart above, stocks have the potential to lose 39% of their value in one year while bonds have only lost 8% of their value. Fixed income should be used for withdrawal needs while stocks are devalued. The correct allocation to bonds and cash equivalents should be correlated to annual income needs times 3-10 years. The amount of multiplier would be determined by one’s risk tolerance and likelihood of withdrawals.

Let’s review this concept with a couple of examples. A 30-year-old investing in their 401(k), IRA or other retirement savings has little use for fixed income and cash equivalents. Since the assets are targeted for retirement, they have over 20 years to recover any short-term market losses. Typically, 10 years from retirement is when we would start to advise adding in fixed income equivalents.

Alternatively, if the above client had a non-qualified investment account and planned to use the proceeds for a down payment for a home in the next 1-3years, it would be advisable to allocate part or all of the expected down payment to bonds or cash equivalents. The amount allocated to fixed income would depend on the current pricing of equity markets. If the market is at an all time high and analysist expect a downturn than it would make sense to move the entire down payment to fixed income. If the market is rebounding out of 20% correction and the short-term outlook is positive, it would be advisable to move part of the down payment to fixed income now and part in the future if the market continues to increase.

Now for a retired 60-year-old who requires $100,000 annually. The answer to the question may vary widely depending on financial situations. If the individual has a pension of $50,000/year and $30,000/year from social security benefits, then $60,000-$200,000 would be an appropriate target for fixed income regardless of the portfolio size. If the market was to decrease drastically this person would be able weather the storm using their fixed income positions allowing time for the equity markets to rebound. If the person mentioned above did not have the pension to rely on the proper fixed income allocation would be $210,000-$700,000.

In today’s economic environment bonds and cash equivalents should be used when equity values are depressed. Instead of selling stocks that may have lost up to 39% of their value, leverage your bonds and cash equivalents. The allocation to fixed income should be able to cover 3-10 years of foreseeable withdrawals from an investment portfolio. Just like the rules of prior decades these are not absolutes. Each situation requires a unique approach and discussion for how to properly mitigate risk.