From the desk of a Financial Planner

Roth or Traditional?

A question we frequently are asked is, “Which is better, a Roth or a traditional IRA/401(k)?” Our typical answer is, “It depends.” There are several factors to consider when making the choice between a Roth investment and Traditional tax deferred investment. They include the current taxable earnings versus potential taxable earnings in retirement, the investment time-frame, and the current mix of qualified, Roth, or Traditional tax deferred investments in a portfolio.

Tax brackets and rates will change over time making it difficult to use your potential taxable earnings as a basis for your decision. The current asset mix will vary from reader to reader, so we won’t spend time reviewing that. For today we are going to focus on the time-frame of the investment and strictly look at it as a mathematical equation to see which strategy would provide the most post-tax benefit in retirement.

For this exercise let’s use a person 30 years old, who will hold their investment for 30 years until age 60. They will invest $5,000/year of their $100,000 annual salary. We will assume that their income will remain unchanged during their career and retirement. We will also assume that any tax savings from the traditional IRA will be invested in a non-qualified account, for retirement. To remain consistent, we will use a 7% annual growth rate on all investment accounts. We will also use the highest marginal tax rate for a single individual making $100,000 annually which is 24%.

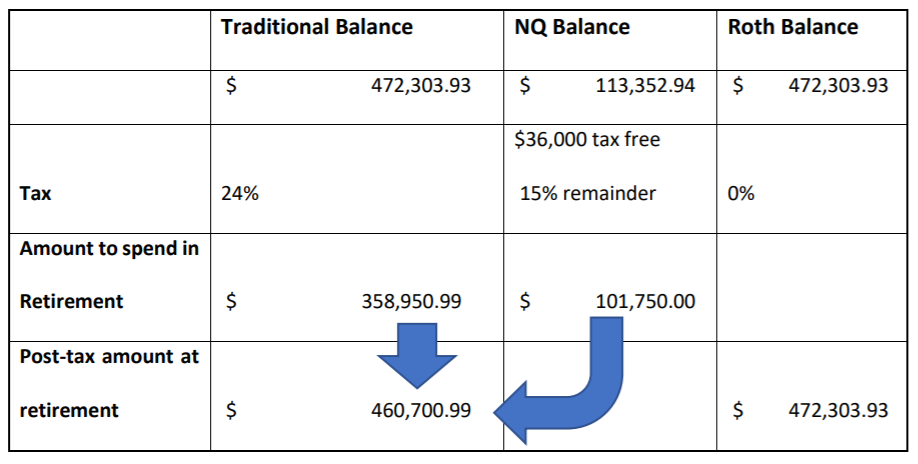

For the Roth and traditional IRA using $5,000 annual contributions and a 7% growth rate over 30 years the account values, before taxes, for both accounts would be $472,303.93 (please see the chart below). The Roth IRA is easy to compute. You would have $472,303.93 to spend during retirement. The taxes have already been paid and there are no further reductions.

For the traditional IRA taxes will be owed on the balance when withdrawn. This reduces your spendable balance to $385,950.99. We still need add in the additional savings from the tax deductions throughout the 30 years. $1,200 invested annually into a non-qualified account at 7% will grow to $113,352.94 after 30 years. $36,000 of $113,352.94 will be a tax-free return of principle. We will assume that the remaining growth will be taxed at a capital gains rate of 15%. This leaves the non-qualified account with an aftertax balance of $101,750. When we add the traditional IRA after tax balance to the non-qualified after-tax balance you arrive at a total of $460,700.99.

As this case shows, the Roth IRA provides more after-tax dollars than the combination of a traditional IRA and non-qualified account. Remember that this case is only looking at the choice from a time value of investing and tax liability perspective. It is also worth noting that rarely do we see our clients invest the tax savings they receive from contributing to a traditional IRA. If the tax savings is not reinvested, the after-tax dollar discrepancy furtherfavors the Roth strategy. It is important to consider all variables before making a financial decision.